FinCEN Issues Update to Corporate Transparency Act

December 28, 2023 |On November 29, 2023, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued an update to the Corporate Transparency Act (CTA), extending the deadline for reporting companies to disclose beneficial ownership information. Once the CTA goes into effect on January 1, 2024, reporting companies created in 2024 will now have 90 days instead of 30 days to file beneficial ownership information with FinCEN. Reporting companies created before January 1, 2024, will still have until January 1, 2025, to disclose this requisite information.

The Corporate Transparency Act: An Overview

The CTA is a law enacted by Congress that will require certain business entities to disclose beneficial ownership information to FinCEN. The purpose of the act is to combat financial crimes, including money laundering, terrorism, human and drug trafficking and tax evasion by creating a centralized database of information—the Beneficial Ownership Secure System (BOSS)—to monitor who owns and operates U.S. business entities. FinCEN will use the BOSS system to identify financial connections between bad actors and shell companies. In general, the public will not have access to the information stored on BOSS.

Information to Be Reported

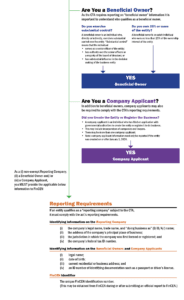

If the CTA applies to you (see below for flow charts with this analysis) the information to be reported will depend on the time that the business entity was formed. Business entities formed on or after January 1, 2024, must report information about (i) the business entity itself, (ii) its beneficial owner(s) and (iii) its company applicant(s). Business entities created before January 1, 2024, need only disclose information about (i) the business entity itself and (ii) its beneficial owner(s).

A parent company may not file beneficial ownership information on behalf of its subsidiary or group of subsidiaries. Each company that falls under the scope of the CTA must file its own beneficial ownership information. Further, companies may not “consolidate” employees across a group of related companies to meet the criteria of a “large operating company” in order to fall under the exemption requiring the entity to employ more than 20 full-time employees. However, if beneficial owners only hold an interest in a reporting company through a parent company, and the parent company is an exempt entity, the beneficial owners may simply report the name of the parent company in lieu of the beneficial ownership information.

Criminal and Civil Penalties for Noncompliance

Failure to comply with the CTA may constitute a “reporting violation” resulting in civil or criminal penalties. Reporting violations include (i) willfully providing false beneficial ownership information to FinCEN and (ii) willfully failing to report full and complete beneficial ownership information to FinCEN. Penalties for such reporting violations may include civil penalties of up to $500 for each day of continued non-compliance or criminal penalties including a fine of up to $10,000 and/or up to two years of imprisonment. A reporting company must correct any mistakes or omissions in its reported information within 90 days of its deadline to report.

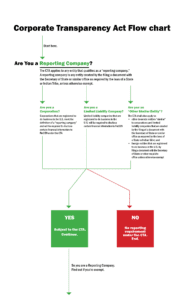

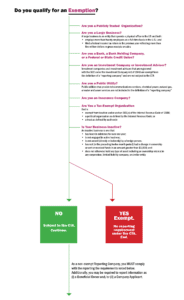

The Analysis: Does the CTA Apply to You?

To view a larger version of each chart, click on the chart. To return to the article, click your browser’s back button.

Reporting Beneficial Ownership Information: The Process

Those subject to the CTA shall report beneficial ownership to FinCEN via a secure filing system that will be made available on FinCEN’s website. This system is still in development but will be available before information must be filed. Additionally, FinCEN will provide a form to report beneficial ownership information. This form will be posted on FinCEN’s beneficial ownership webpage once it is available to the public. There is no fee to submit beneficial ownership information to FinCEN.

Changes to Reported Beneficial Owner Information

If there are any changes to reported beneficial ownership information, the reporting company must file an updated report with FinCEN within 30 days of the date of the change. Such changes may include a change to the business name; a change in a beneficial owner, such as a new CEO,; or a change to a beneficial owner’s name, address or identifying number. Note, however, that the initial beneficial ownership report should include only the current beneficial ownership information. The report need not include former beneficial owners who no longer qualify as beneficial owners under the CTA.

If information about a reporting company’s company applicant changes after submitting the beneficial ownership information, this change does not need to be submitted to FinCEN. Moreover, a company applicant will not be removed from a beneficial ownership information report regardless of whether they no longer have a relationship with the reporting company.