The Corporate Transparency Act: Will it Impact You?

October 4, 2023 |Please see here for a more recent article reflecting the November 2023 updates to the Corporate Transparency Act.

The Corporate Transparency Act (CTA) will affect most small, privately held businesses starting January 1, 2024. Does the CTA apply to you?

What is the CTA?

The CTA, a law enacted by Congress, will require certain business entities to disclose beneficial ownership information to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). The purpose of the act is to combat financial crimes, including money laundering, terrorism, human and drug trafficking and tax evasion by creating a centralized database of information about who owns and operates U.S. business entities. This database is intended to identify financial connections between bad actors and shell companies.

Why is the CTA Important?

The CTA will soon require action from certain business entities. Thus, it is essential to understand whether the CTA applies to you, and if it does, what you will be required to disclose to FinCEN. Failure to comply may result in civil or criminal penalties!

To view a larger version of each chart, click on the chart. To return to the article, click your browser’s back button.

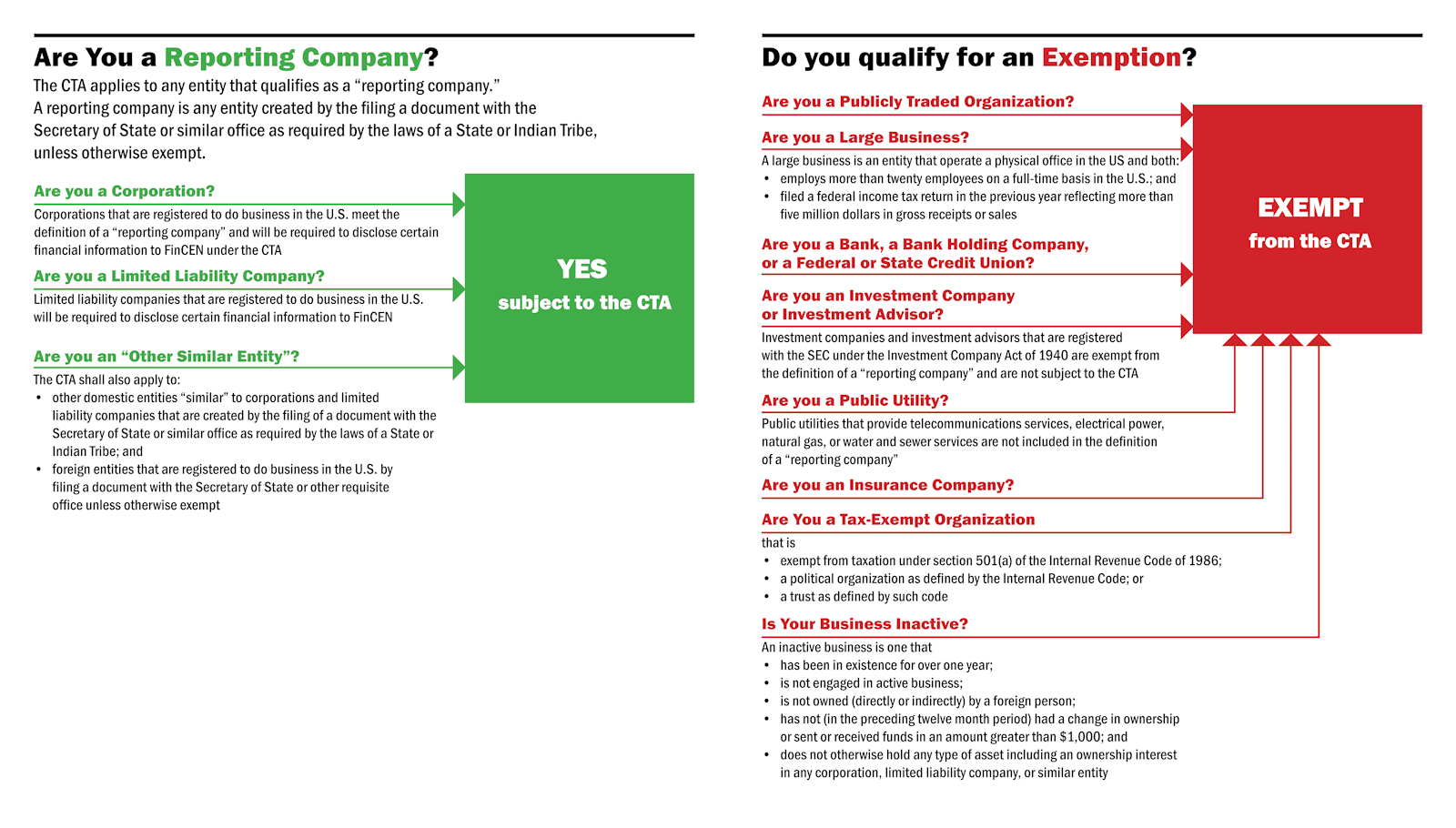

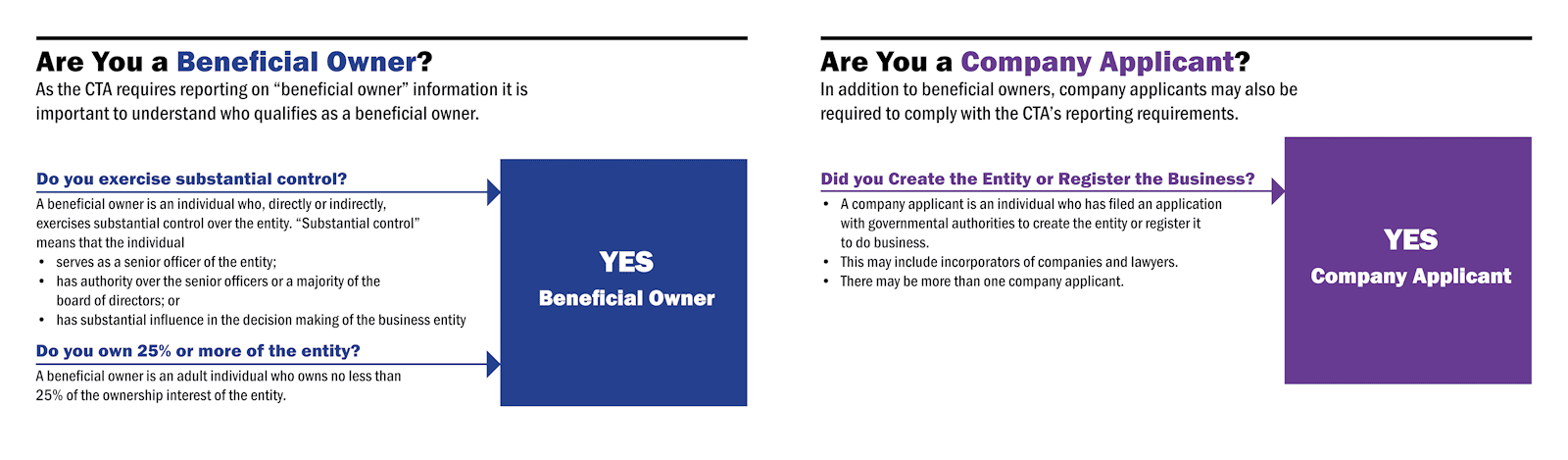

The Analysis: Are You a Reporting Company or Exempt?

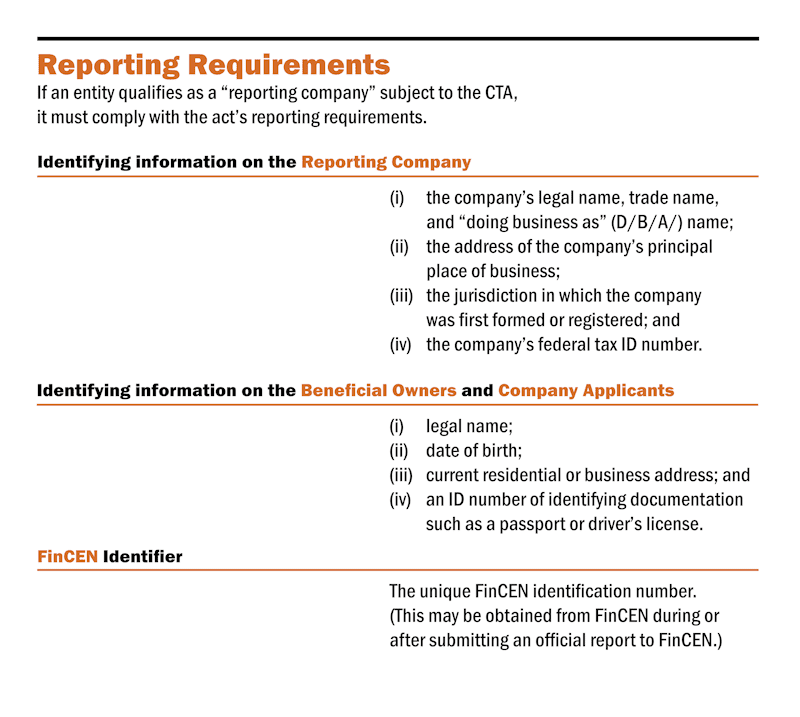

Reporting Requirements

If an entity qualifies as a “reporting company” subject to the CTA, it must comply with the act’s reporting requirements.

Who Will have Access to Beneficial Owner Information?

Who Will have Access to Beneficial Owner Information?

Information reported to FinCEN will be stored on the agency’s Beneficial Ownership Secure System (BOSS). In general, the public will not have access to the information stored on BOSS. Reporting companies may comply with the CTA by submitting reports through the BOSS interface. This information will be subject to the highest information security protection level and will be available to federal agencies that request the information on behalf of a law enforcement agency, prosecutor, or, in some instances, a judge of another county.

When Does the CTA Take Effect?

The CTA goes into effect on January 1, 2024. However, timing for compliance with the CTA is dependent on when the reporting company was formed. A reporting company created or registered before January 1, 2024 will have a year—until January 1, 2025—to file its beneficial owner information and need not disclose the identity of the company applicant.

On the other hand, a reporting company created or registered after January 1, 2024 shall be required under the CTA to file its beneficial ownership information within 30 days of formation or registration.

What Are the Penalties for Noncompliance?

Failure to comply with the CTA may constitute a “reporting violation” resulting in civil or criminal penalties. Reporting violations include (i) willfully providing false beneficial owner information to FinCEN and (ii) willfully failing to report full and complete beneficial ownership information to FinCEN. Penalties for such reporting violations may include fines up to $10,000 and imprisonment for up to two years.

The CTA’s Application to You

As the CTA is a new law, there are components that are vague and raise questions about how the law will be applied. Discussion of your entity structure and ownership with your attorney can help address disclosure requirements and inadvertent failure to comply with the law’s reporting requirements.